Beyond Banking

Our Foundation

Rooted in the rich tradition of Western wealth management, First Western Trust is more than a bank; we are a partner in your financial journey. Established to serve the unique needs of high-net-worth individuals, families, and businesses, our ethos is built on a foundation of custom banking, wealth planning, and investment management solutions. With a commitment to understanding each client’s unique story and ambitions, we tailor our solutions to not only meet but exceed their financial aspirations. Our legacy is defined by the success and satisfaction of our clients, ensuring they achieve their desired lifestyle and secure a lasting legacy for generations to come.

Celebrating Decades of Service

Founded in 2002 by Scott Wylie and a coalition of Western business luminaries, we laid the groundwork for a new kind of financial institution. Officially opening our doors as First Western Trust in 2004, we embarked on a journey to redefine wealth management. Our unwavering dedication lies in delivering personalized service and refined solutions, fostering financial journeys that mirror the enduring impact of our clients’ legacies. As we celebrate our founding and continuous growth, we remain committed to establishing lasting partnerships and creating innovative financial solutions for every chapter of your story.

Engaged Citizenship

First Western Trust is deeply committed to contributing positively to our communities. Our efforts focus on fostering economic growth, supporting the arts, and promoting equity and equality. We believe in empowering local entrepreneurs to stimulate economic development, celebrating and supporting Western arts and culture, and ensuring that our communities are inclusive, offering equal opportunities for all. Through active engagement and philanthropy, we strive to substantially impact the quality of life in the communities we serve and beyond.

Economic Development through Entrepreneurship

We actively drive innovation and economic growth by supporting local entrepreneurs, offering resources and financial backing to transform visionary ideas into reality.

The Arts

We are staunch supporters of the arts, contributing to the cultural richness of the West by investing in local artists and initiatives that make art accessible to a wider audience.

Equity and Equality

At the heart of our community efforts is a commitment to promoting inclusivity and ensuring everyone has access to the opportunities they need to succeed.

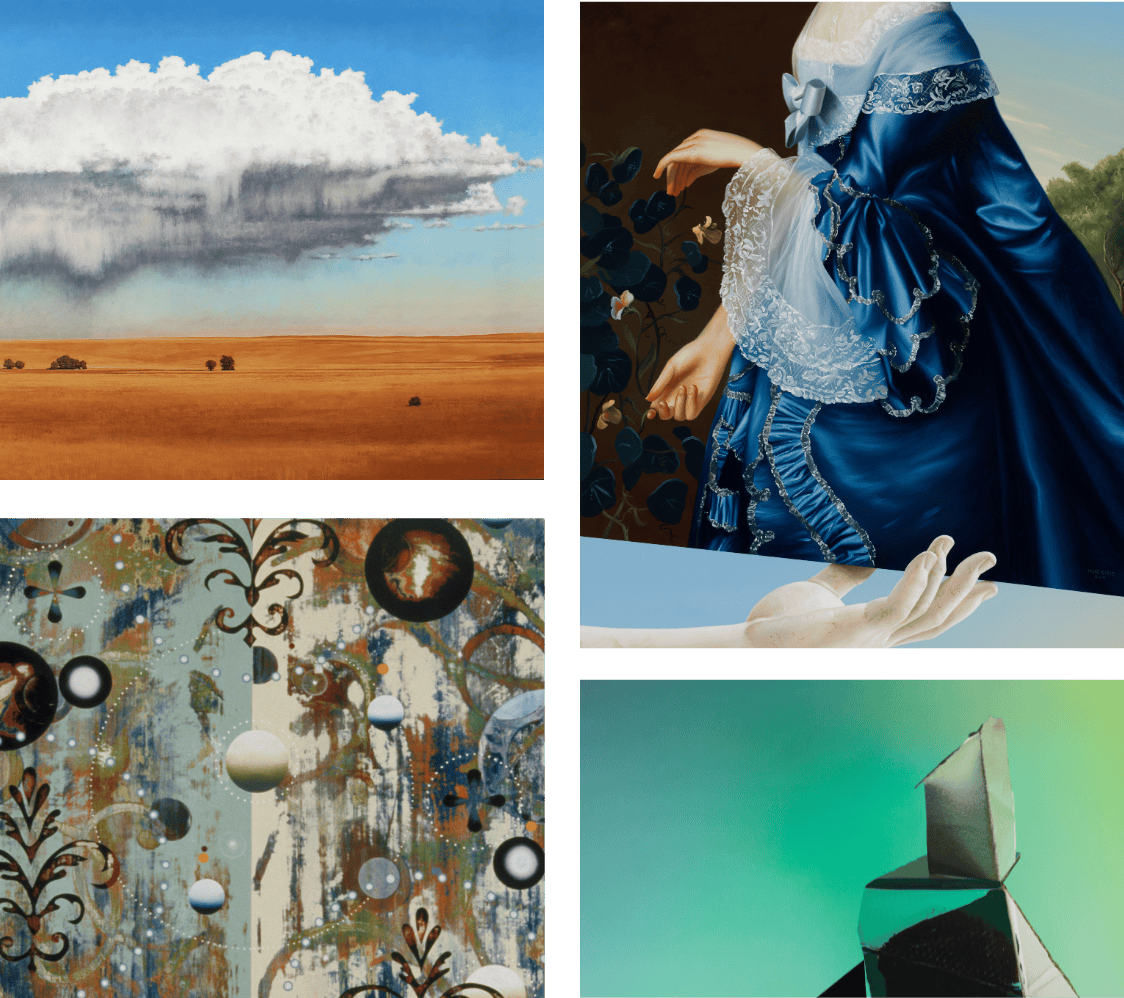

Artistic Heritage

The First Western Trust art collection is a testament to our dedication to Western artists and philanthropy. It represents our commitment to cultural engagement and supports the creative community. This collection highlights the unique spirit and talents of the West, inviting clients to explore and connect with our artistic legacy. Discover the art and the impact of our support by viewing the FWT art collection.

First western art collection

ConnectView®

ConnectView embodies our comprehensive banking approach, integrating all dimensions of wealth to enhance your financial and personal well-being.

Legacy Wealth

Building enduring legacies through strategic wealth planning.

Financial Wealth

Maximizing financial potential with bespoke investment strategies.

Relational Wealth

Strengthening community and personal connections through meaningful engagement.

Experiential Wealth

Enriching lives with unique experiences and opportunities for growth.