Cyber Attackers Aimed at Customers

January 30, 2023

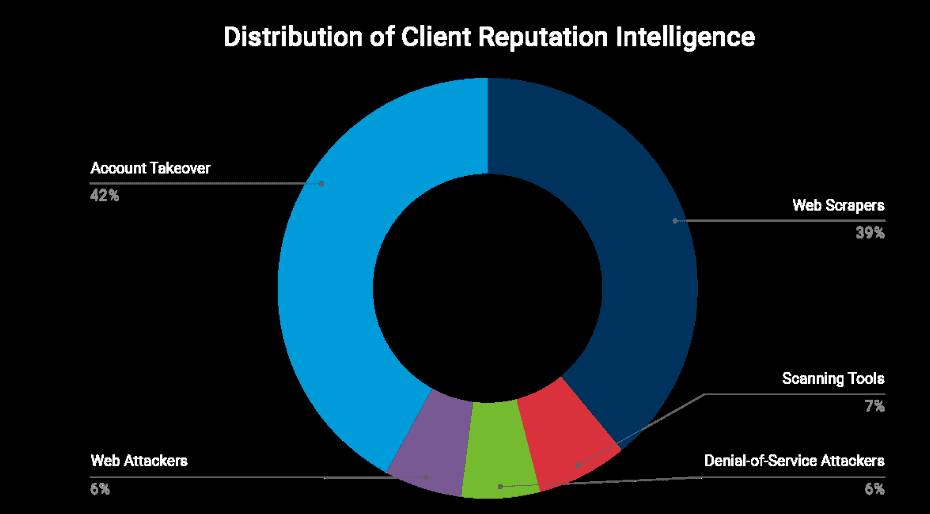

According to Akamai, a leading U.S. cybersecurity and cloud service provider, more than 80% of attackers are aiming their attacks at financial institution clients.

© 2022 Akamai

Here are potential risks to you as a consumer of banking services:

Account Takeover

These attacks include cybercriminals taking ownership of online accounts by stealing passwords and usernames. Account takeovers are often initiated using social engineering (persuading account holders to share credentials through spoofing or deception); data breaches of financial institutions, shopping channels, and other online companies; and phishing (clicking on a virus/ransomware link or attachment allowing computer compromise).

- Prevention of Account Takeover – Use Multi-Factor Authentication (MFA), which can be a secondary information fact (security phrase or name), a token/dongle or another secondary password generator, or a bio-form such as a face ID, iris, fingerprint, or other individualized bio-ID. Reputable online sites should have this enabled.

Web Scrapers

Businesses use a software tool, such as a bot, to extract targeted information in large amounts from an internet web page and store it for other use. Scraping is sometimes legitimately conducted by businesses to track competitors or other metadata. Of late, e-commerce websites have become a key target for cybercriminals. Attacks can focus on checkout applications and online activities (such as those used in financial services) that require login credentials.

- Web Scraping Prevention – First Western’s web-facing applications have web scraping protections that apply controls and monitor for suspicious activity and requests.

Denial of Service (DoS) Attacks

These attacks occur when legitimate users cannot access information systems, devices (laptops, for example), or other network resources due to malicious threat activity. Services that may be impacted are email, websites, online accounts (such as a bank account), or other services that require a computer or network use. Attackers take advantage of weaknesses in devices using systems and networks.

- DoS Prevention – First Western has multiple layers of virus, firewall and security setting configurations that protect against DoS attacks.

- Client Actions – As a user of banking services, make sure to follow good password security to minimize access that others could gain to your accounts and laptop/desktop computer.

- Create Strong Passwords – Passwords should be a minimum 12-15 characters, a combination of alpha (upper and lower case), numeric, and symbols, and change every 90 days. Make sure to follow strong password best practices.

- Do Not Reuse Passwords – Password reuse can give a hacker the keys to your kingdom: if they can access one account, they can access the rest with the same password.

- Do Not Share Passwords – Unless other users are a closely trusted part, such as a spouse, it is better for all users to have their own passwords to access devices and accounts.

- Keep Devices Up to Date – Always install software updates and keep virus protection current on all devices, including your phone.

Scanning Tools Used by Hackers

Network vulnerability scanning is used by financial institutions and other companies to seek and mitigate vulnerabilities, often updates in software that needs to be patched by security staff. Hackers also use the same tools used by legitimate parties.

- Client Actions – Clients should use the same strategy as that for preventing DoS attacks:

- Strong passwords

- Update passwords at a minimum every 90 days

- Do not reuse passwords

- Do not share passwords

- Maintain up-to-date operating systems (accept notices of updates and installation) and virus protection

Web Attackers

Web applications are computer programs that allow website users to conduct business using one of many browsers, such as Chrome. Banking applications are used in just this way, daily, by millions of people on countless bank networks. Banks have databases containing valuable personal and account information. As such, they are frequent targets of attacks. Since they must always be available to everyone, they cannot be protected by firewalls, and hackers frequently try to exploit them. Malicious hackers look for vulnerabilities in web applications.

- First Western’s Actions – First Western use ongoing scanning activity to apply layers of protection to prevent web application attacks:

- Users should always look for HTTPS-encrypted connections that ensure connections are encrypted to protect data and information between users and applications (look for the padlock).

- Make sure passwords are updated and use strong characteristics.

- Limitations on failed login attempts and weak password messages are just a handful of user protections employed.

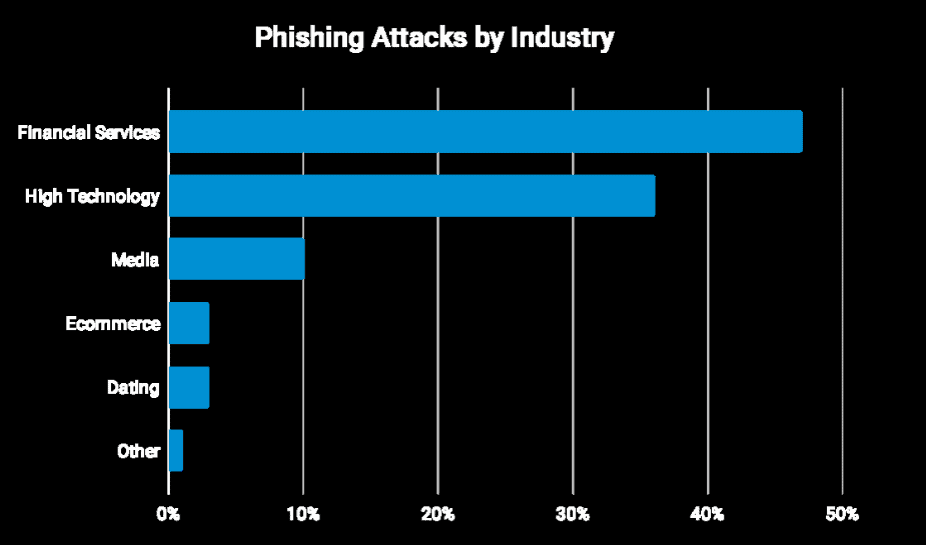

Finally, banking service consumers must be vigilant about emails they receive from senders that appear to be from their bank or other businesses requesting payment information. Financial services clients are often phished by hackers hoping to conduct account takeovers and a myriad of other malicious scams aimed at taking your funds.

The best prevention is KNOWLEDGE. First Western frequently communicates phishing risks to clients and our personnel. Knowing the risks of email use in commerce is the best weapon against being duped by a bad actor. Here are some warning signals:

- A sense of urgency that your account information is incorrect or has been compromised, and the sender asks you to click a link to correct it or access an attachment.

- Be wary when sentence structure in communications does not resemble standard American English.

- The sender email is not one you are expecting or is it one you receive email from but includes slight variations, such as lending@yourbank.com is received as lending@yoursbank.com, your bank is requesting something that is atypical, or is requesting sensitive information (outside of a secure email system).

- Email coming to you from undisclosed recipients could be aimed at a larger audience in a ransomware attack or other nefarious scam.

- The email comes to you from a time zone that is not normal for a known sender, such as 2 a.m., indicating it could be a spoofed email from another part of the world.

© 2022 Akamai

What Should Clients Do?

- Never click on attachments, but rather go to your online account and securely log in.

- If you suspect a scam, report it to the person you do business with at your bank.

First Western will only ask you to supply your sensitive account information in a secure email communication but will never request this information unsolicited.

As we look to 2023, arm yourself with a healthy bit of skepticism and keep up to date on scams and trends as an informed banking services consumer. We do everything in our effort to train our associates and continually update our security solutions to protect you, our valued First Western client.