Wyoming Trust

When it comes to estate planning, not all states provide you with the same advantages. Wyoming has a well-deserved reputation as an excellent place to form a new trust or migrate an existing trust. Wyoming is consistently ranked as one of the most favorable trust jurisdictions and one of the most business-friendly states for its low tax burden, fiscally sound governments, pro-business legislature, and reasonable, business-friendly regulations, which provide uncommon estate planning opportunities for individuals and businesses. First Western has the expertise and experience as a Wyoming trust company to help you with your trust, with locations in Laramie and Jackson Hole.

Unique Advantages of Wyoming Asset Protection Trusts

Wyoming is one of the only states that has enacted statutes to provide asset protection benefits through a “self-settled trust.” These trusts allow you to both create the trust and be a beneficiary. A self-settled trust also protects you and your beneficiaries from the claims of creditors, which helps ensure that your wealth is passed on in the way you intended.

Another advantage to Wyoming is the opportunity to create a purpose trust. Unlike a traditional trust, which is created for the benefit of a group of named beneficiaries, these trusts are designed to fulfill a unique goal you may have. Examples of a purpose trust are a trust that allows you to maintain an art collection or care for a family pet after your lifetime.

Wyoming asset protection trusts also can help you build a lasting legacy, protecting your family for generations. Most states limit the number of years a trust may exist, but Wyoming allows a trust to last for 1,000 years, providing greater asset protection and generation-skipping estate tax benefits for family members. To find out more about self-settled trusts and the benefits of Wyoming trusts, contact our Jackson Hole team with any questions!

Why Wyoming?

- No state personal or corporate income tax

- No state estate tax

- No state gift tax

- No state tax on retirement income

- Low property tax

- Self-settled trusts

- Asset protection trusts

- Purpose trusts

- Fiscally strong state (would take Constitutional amendment to impose a state income tax)

- Capable of avoiding transfer taxes for 1,000 years

- Easy trust migration and reformation

Why First Western Trust?

- Flexible and personal service for our trust clients

- Highest fiduciary standards

- Top wealth planning firm in Jackson

- Sophisticated & experienced professionals

- Dedicated & local Wyoming team

- Strong corporate trust department and support

- Sound judgement

- Cultivate lifelong relationships with our clients and their advisors

- Competitive fees

- Serve as directed and discretionary trustee

- Fiduciary for diverse asset classes

Wyoming Accreditations

- AAA Credit Rating-Highest Rating Possible (Standard and Poor’s)

- Lowest State/Local Tax Burden in the United States (Tax Foundation)

- #2 Best Business Climate (U.S. Chamber of Commerce Foundation)

- #2 Best Run State in the U.S. (24/7 Wall Street)

- #2 Highest Rate of Trust in the State Government (Gallup)

Our Wyoming Trust Team

Our First Western Trust Jackson Hole team provides prominent estate planners and leaders in estate planning law and practices. Our team is committed to understanding your goals for each dimension of your wealth, and with our diverse expertise, we partner to create a wealth plan to help you achieve your objectives.

Wyoming Asset Protection Trusts Resources

As you design your estate plan, there are a number of financial tools you may consider. We encourage you to explore our resources below to learn more about the benefits of asset protection trusts and the advantages of partnering with a Wyoming trust company like First Western Trust.

8 Reasons to Establish a Wyoming Trust

In a brief article, First Western Trust breaks down the unique advantages of Wyoming trusts and discusses 8 reasons why they can provide significant benefits over other states – even if you do not live in Wyoming.

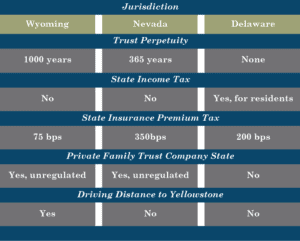

State Comparison by Jurisdiction

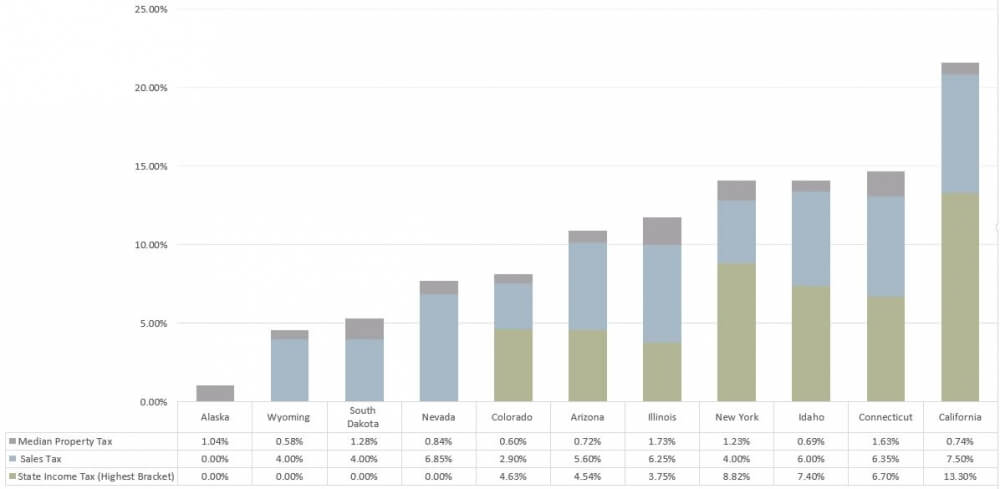

State Income, Sales & Property Tax Comparison

Fees

You will find our fees are highly competitive with other Wyoming trust companies. Fees are generally based on the value of assets under management. However, fees can vary depending on the nature of the assets, the type of trust and level of administration required.

Investment and insurance products and services are not a deposit, are not FDIC- insured, are not insured by any federal government agency, are not guaranteed by the bank and may go down in value.